Governance Tokenomics

Info

Single Asset staking is an outdated governance tokenomics model that reduces a tokens liquidity, increases token volatility and slippage, Incentivizes mercenary capital, and creates fragmented and expensive incentive programs. ve8020 combines the flexibility of asymmetric weighted pools with the efficiency of vote-escrowed mechanics to unlock the next evolution of DAO Governance tokenomics.

Challenges surrounding Governance Tokenomics

Single Asset staking is an outdated governance tokenomics model that reduces a tokens liquidity, increases token volatility/slippage, Incentivizes mercenary capital, and creates fragmented and expensive incentive programs.

The ve8020 Initiative as a Solution for Governance Tokenomics

ve8020 combines the flexibility of asymmetric weighted pools, with the efficiency of vote-escrowed mechanics to unlock the next evolution of Governance tokenomics to unlock deep Liquidity, asymmetric asset exposure with minimised IL, and highly efficient incentive programs.

Increase Your Token Liquidity

Due to incentivising single-staked positions and removing a majority of the token supply available for trading, all single-sided staked protocols run into a token liquidity problem. ve8020 will directly deepen your protocol’s native token via the integration of an 8020 pool token for governance.

Drawbacks of single-staked tokenomics and reduced liquidity

While incentivising staking successfully increases governance participation, it also (un)effectively reduces the circulating supply available for swaps. As a result, a smaller portion of capital is supplied to liquidity pools and this lack of liquidity leads to a number of issues.

- Increased slippage

- Inability to facilitate larger trades

- Higher price volatility for the underlying tokens

Benefits of ve8020 for increasing token liquidity

Harnessing a liquidity pool token as the governance token, the 8020 model circumnavigates the issue of locking single-staked assets liquidity away. Instead of staking the token itself, users stake the pool token, allowing the underlying tokens to actively participate in swaps. For the first time in governance history, as the sum of staked governance tokens grow, the available trading liquidity increases rather than decreases. Additionally, via combining this with vote escrowed mechanics, a protocol ensures liquidity is available for long time durations.

- Reduced slippage

- Ability to facilitate large trades

- Lower price volatility

Balancer's BAL tokenomics Case Study

By addressing the limitations of traditional single-sided staking, the 8020 model fosters an ecosystem where liquidity thrives, enabling smoother and more efficient trading experiences for users. For reference, at the time of writing, Balancer’s 8020 governance pool hosts a TVL of over $145m, leading to BAL being one of the most liquid tokens in DeFi.

Unlock highly efficient incentive programs

Unlike a single staking model which requires DAOs to direct incentives at other positions to ensure liquidity is available for swaps, a ve8020 model ensures a SINGLE, concentrated source for protocols to direct incentives at. Combined with swap fees, core pools, and BAL liquidity flywheels, this unlocks an extremely efficient incentive program for protocols.

Traditional single staked position inefficiencies for protocol incentive programs

With the need to facilitate swaps, the traditional single-sided model necessitates incentives for both the staking pool and other liquidity pools. By integrating the governance token into an 8020 liquidity pool, the need to split and direct incentives to other DEXs/CEXs is eliminated. Incentives can be directed to one place offering users a more enticing position.

Benefits of ve8020 in optimizing incentive programs

In essence, the 8020 model consolidates all incentives, removing the need to fractionalize liquidity across multiple markets. As a result token supply is concentrated in one primary pool, increasing liquidity deposits, vastly reducing slippage and offering a simpler, more cost-effective incentivization program. But that’s not all, by utilising a liquidity pool BPT for governance an additional stream of incentives automatically presents itself — Swap Fees. A portion of these fees flow to liquidity providers as an incentive for providing liquidity. Additionally, Balancer implements an 8020 Launchpad/ core pool models that can recycle protocol fees back into the pool. Check out the pages below to find out more.

- Liquidity Mining

- 8020 Launchpad

- Core Pool Status

Radiant Capital Case Study

28 days after adopting the 8020 model, Radiant increased token liquidity to almost $43M, facilitated 44,046 swaps and generated $644,744 in swap fee. To date, the radiant 8020 LP hosts over $73 million in liquidity with Liquidity Providers earning an additional $1.7 million in swap fees that would never have been possible with a single-staked model.

Offer LPs Asymmetric Upside with minimal IL

Ensure investors still have asymmetric exposure to your underlying native token while harnessing the many benefits of an 80/20 pool.

Drawbacks of utilizing traditional 50/50 LP positions for governance tokenomics

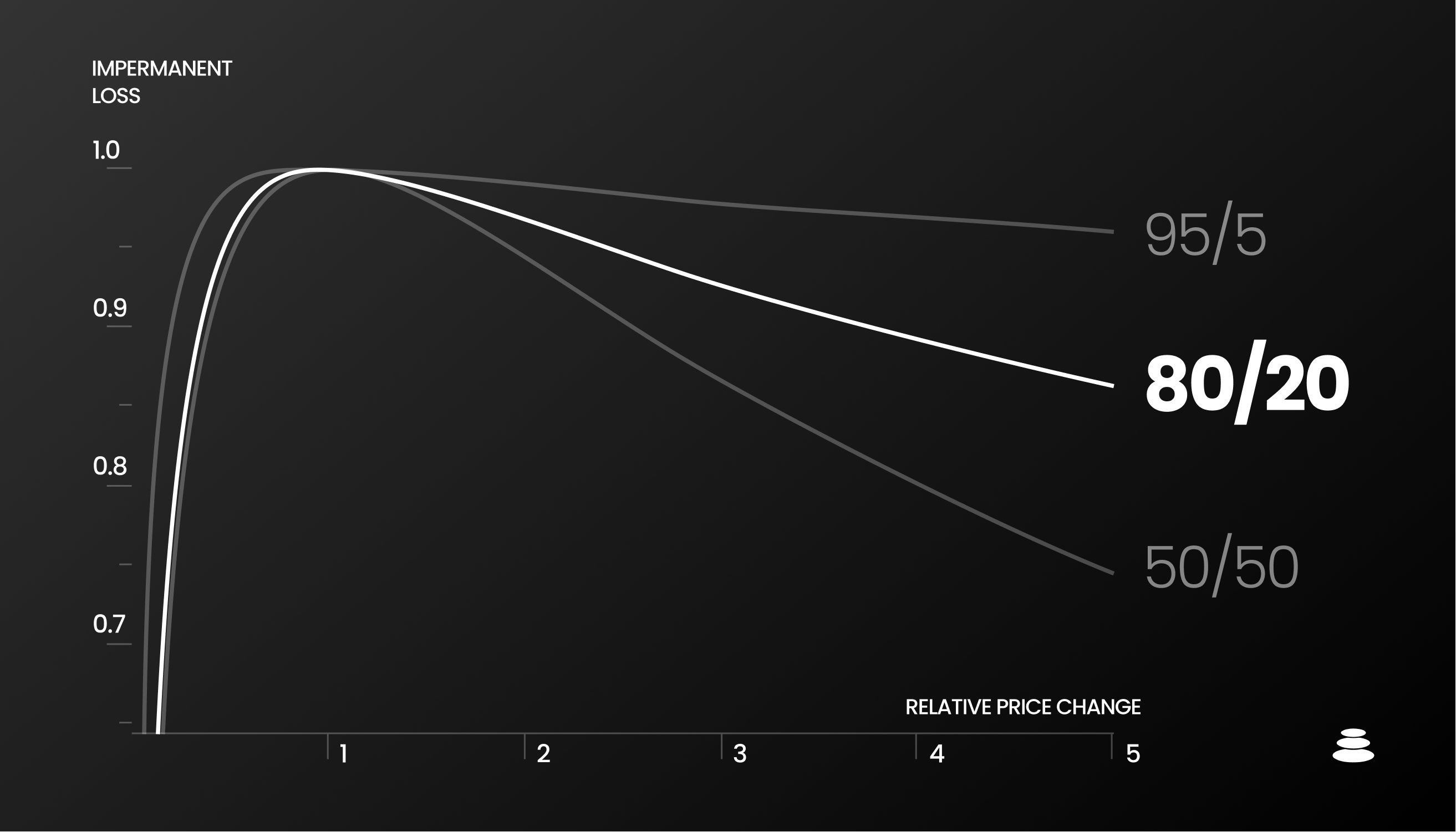

A 50/50 pool is generally avoided for this purpose as it offers limited exposure to the native token while posing increased IL potential should the native token appreciate substantially. While there is still some inherent risk of impermanent loss, as illustrated in the figure below, the 80/20 split offers substantially reduced exposure to IL, while retaining the benefits of deep liquidity and exposure to the base token

Benefits of 80/20 token exposure

By striking the right balance between token composition, the 8020 model maximises exposure to the underlying native token with liquidity providers enjoying the advantages of deep liquidity, asymmetric exposure to the base token, and minimised impermanent loss.

Enter a well-connected and welcoming ecosystem

By utilising a ve8020 governance position, protocols enter a budding collective of DAOs known as the 8020 Initiative. This collective of notable protocols have helped amplify all new participants entering the ecosystem. Balancer will also provide comms, host twitter spaces, and create in-depth content in relation to your protocol / governance tokenomics.

Below are a few of our successful 8020 ecosystem participants:

Onboarding

ve8020 onboarding requires the creation of a weighted pool with a vote escrowed position on top. Protocols only need to incentivize the locked position to ensure long-term liquidity, with a Balancer grant there is a possibility to boost these incentives further. There are also means to generate liquidity mining incentives LP on Balancer. - Core Pool Designation.

Info

Follow our Balancer v2 Onboarding Guide

Resources

If you want to learn more about these concepts in more detail, follow these in-depth articles for more information

- Articles about ve8020 tokenomics

- Twitter Threads about ve8020

- Analytics resources

- Uniswap Migration tool