Boosted Pools

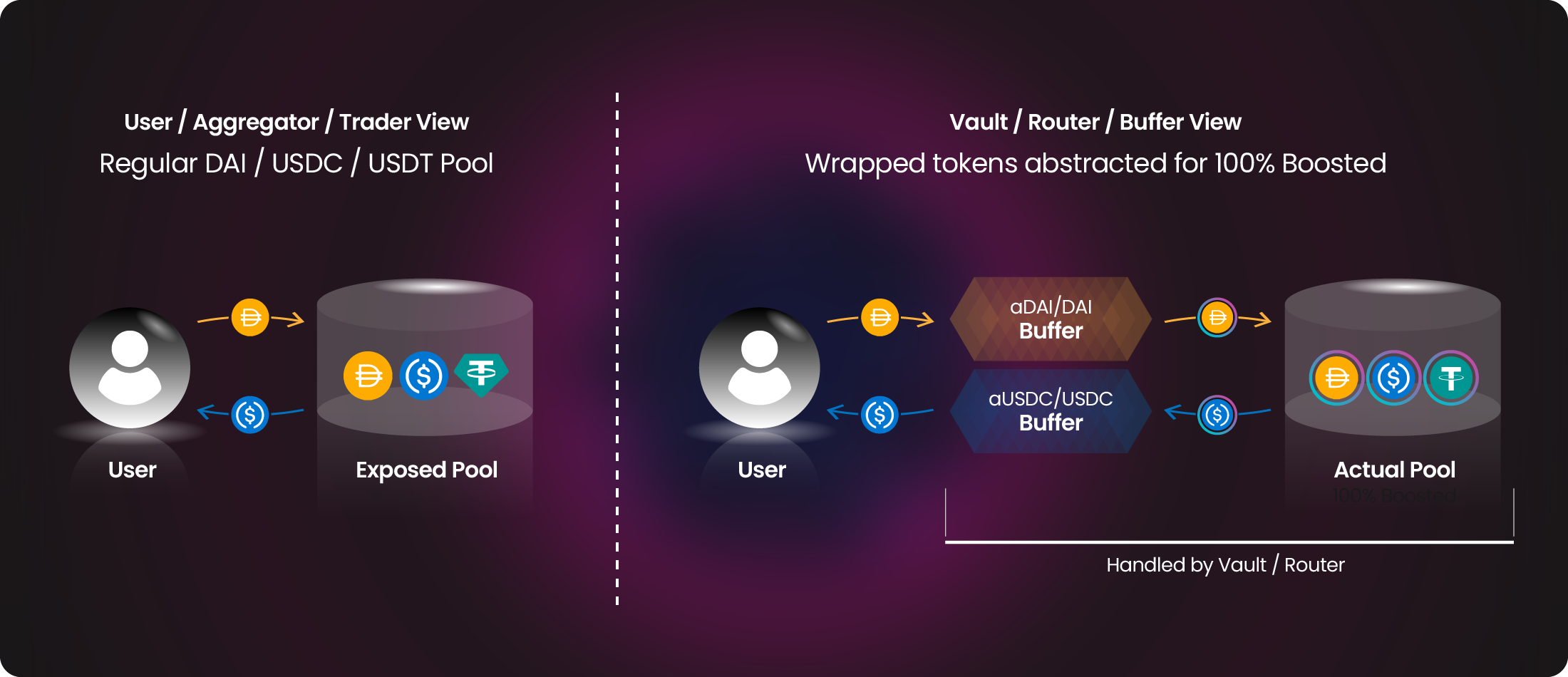

Balancer v3 will introduce an evolution of boosted pools that maximize the utilization of all the underlying pool liquidity into lending markets to optimize yield. Unlike traditional Boosted Pools, boosted pools in Balancer v3 deposit 100% of all liquidity into yield-generating strategies to optimize capital efficiency. Additionally, with the integration of all-new buffers, users can seamlessly swap between base assets (e.g. USDC and DAI) while LPs reap the benefits of pools holding 100% yield-bearing tokens (e.g. aDAI and aUSDC). Buffers are not pools and contain very simple and limited logic adjacent to the vault, avoiding possible security issues like the recent Boosted Pool incident.

Boosted pool technology ensures that all stablecoins on the DEX can harness the power of yield-bearing appreciation. Liquidity is seamlessly routed to external lending markets whilst the underlying assets are always available for swaps. This iteration of the boosted pool type showcases composable and connected smart contract technology and pave the way for sustainable yield generation in DeFi.